Learn how to borrow money from opay loan app and get UpTo 500k without collateral, paperwork or hassle.

In this introduction, we will cover the basics of how to borrow money from Opay, including the different opay loan types and the requirements for borrowing money from Opay.

Overview On How To Borrow Money From Opay

Fintech companies like OPay offers a convenient and easy way to borrow money in Nigeria. You can borrow money from OPay using your smartphone, and you will receive the loan amount in your OPay wallet within minutes.

OPay loans are available to individuals who meet the eligibility requirements, and the interest rates and repayment terms are competitive.

If you are considering borrowing money from OPay, it is important to carefully review the terms and conditions of the loan before applying.

You should also make sure that you understand the interest rates and repayment terms, and that you have a budget in place to repay the loan on time.

How Does Opay Loan Work?

OPay Loan, also known as Okash Loan, is a mobile loan product offered by OPay, a mobile money platform in Nigeria. It allows users to borrow money quickly and easily using their smartphones.

To borrow money from OPay Loan, you must first have an active OPay account with a transaction history.

Once you have met this requirement, you can apply for a loan using the OPay app or the OPay USSD code. ( FAQs: Can I get a loan without BVN in Nigeria).

How To Borrow Money From Opay With Ussd Code

- Dial *955# on your phone. This will open the OPay USSD menu.

- Select the “Loans” option. You can do this by pressing the number corresponding to the “Loans” option on your phone.

- Apply for the loan eligible to you. OPay will display a list of loan amounts and repayment terms that you are eligible for. Select the loan amount and repayment term that you want, and then follow the prompts to apply for the loan.

- Get your loan in your account. Once your loan application is approved, OPay will disburse the loan amount into your OPay wallet. You can then use the loan proceeds to make payments or withdraw the cash.

Please note that you must have an active OPay account with a transaction history in order to borrow money from OPay using the USSD code.

You must also be a Nigerian citizen and at least 18 years old and same thing applies when it comes to Borrowing money with access bank loan code.

How To Borrow Money From Opay Using The Opay Loan App

To borrow money from OPay using the OPay app, follow these steps:

- Open the OPay app and log in to your account.

- Tap on the “Loans” icon.

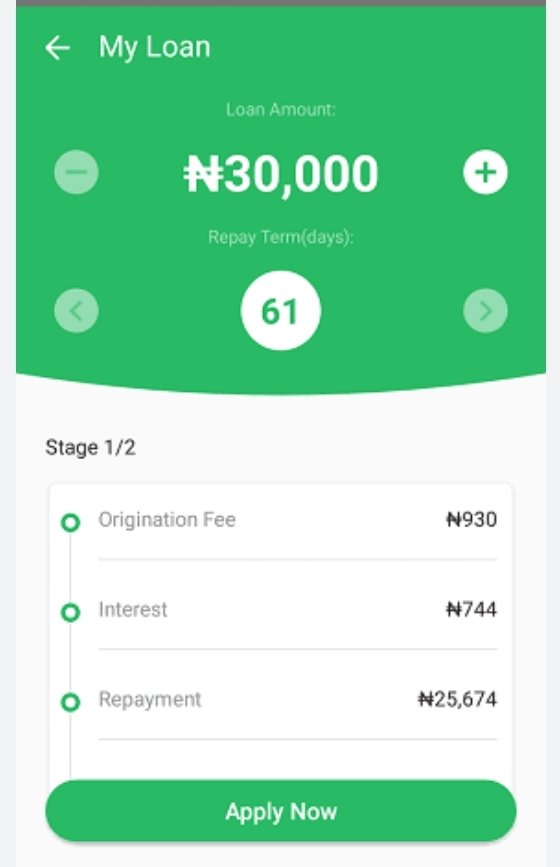

- Select the loan amount and repayment period that you want.

- Review the terms and conditions of the loan, and then tap on “Apply Now”.

- Enter your BVN and other required information.

- Once your application is approved, you will receive the loan amount in your OPay wallet.

Eligibility Requirements To Borrow Money From Opay

To be eligible to borrow money from OPay, you must:

- Be a Nigerian citizen.

- Be at least 18 years old.

- Have a valid BVN.

- Have an active OPay account with a transaction history.

Note: OPay may also have other eligibility requirements, such as a minimum income requirement or a good credit score requirement.

Opay Loan Interest Rate

The interest rate for OPay loans is between 1% and 3% per month, depending on the loan amount and repayment period. This means that the annual interest rate (APR) can range from 12% to 36%.

For example, if you borrow ₦10,000 for 3 months at an interest rate of 2% per month, you will pay ₦600 in interest. The total amount you will repay is ₦10,600.

It is important to note that the interest rate is calculated on a daily basis. This means that the earlier you repay your loan, the less interest you will pay.

OPay also charges an origination fee for all loans. The origination fee is typically between 1% and 3% of the loan amount. This fee is charged upfront, before you receive the loan amount.

Overall, the interest rates for OPay loans are relatively competitive. However, it is important to compare the interest rates offered by different lenders before you borrow money.

How To Repay Your Opay Loan?

To repay your OPay loan, you can use the OPay app or the OPay USSD code.

Using the OPay app:

- Open the OPay app and log in to your account.

- Tap on the “Loans” icon.

- Tap on the “Repay” button next to the loan that you want to repay.

- Enter the amount that you want to repay.

- Tap on “Repay Now”.

Using the OPay USSD code:

- Dial *955# on your phone.

- Select the “Loans” option.

- Select the “Repay” option.

- Enter the loan amount that you want to repay.

- Enter your OPay PIN.

- Tap on “Repay.

What happens if you default on your OPay loan?

If you default on your OPay loan, you may be charged late fees and interest. You may also be suspended from using the OPay platform. In some cases, OPay may also take legal action to recover the loan amount.

It is important to note that OPay does not tolerate late repayments. If you are unable to repay your loan on time, it is best to contact OPay customer support as soon as possible to discuss your options.

Conclusion On How To Borrow Money From Opay

To sum up, borrowing money from Opay is a simple and convenient process. You can apply for a loan online or through the Opay app, and the loan amount and repayment terms vary depending on your individual needs and credit history.

Once you’re approved, the money is deposited directly into your bank account or wallet.

Remember to review the terms and conditions of your loan agreement before you sign.

Have I answered all your questions about borrowing money from Opay? If yes let us know what you think in the comments section.