Access Bank loan code is a service that allows you to apply for a loan directly from your mobile phone.

Access Bank user’s can apply for a payday loan using access bank code which is *426# or *901#, and it’s available to both Access Bank customers and non-customers.

With the access bank loan code, you can apply for a quick loan of up to N500,000, and you can get your money within minutes.

In this intro, we will tell you everything you need to know about the Access Bank loan code. Ready to learn more? Also Read On: Types of Loans without bvn in Nigeria.

Types Of Loans Available Through Access Bank Loan Code

There are three types of Access Bank loans available through their loan code:

- Payday Loan: A quick and easy loan for salary and non-salary earners, with no documentation or collateral required. The maximum loan amount is ₦500,000, and the repayment term is 30 days.

- QuickBucks: A short-term loan for salary earners, accessible through the QuickBucks app or website. The maximum loan amount is ₦1 million, and the repayment term is 90 days.

- Salary Advance: A loan for salary earners, accessible through the Access Mobile App. The maximum loan amount is 200% of your monthly salary, and the repayment term is 180 days.

How To Apply For A Loan Using The Access Bank Loan Code?

To apply for a loan using the Access Bank loan code, follow these steps:

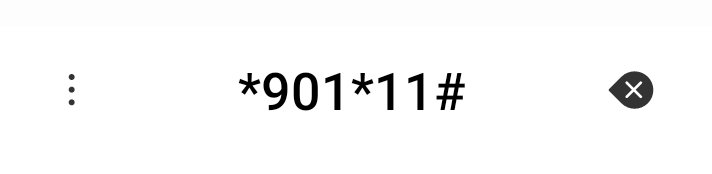

1. Dial *901*11# or *426*9# on your mobile phone.

2. Select the loan product you want to apply for:

- 1 for Payday Loan

- 2 for QuickBucks

- 3 for Salary Advance

3. Enter your Access Bank account number.

4. Enter the loan amount you want to borrow.

5. Enter your BVN.

6. Follow the prompts to complete the loan application.

Once your application is submitted, it will be processed by Access Bank. If your application is approved, the loan will be disbursed into your Access Bank account within 24 hours.

Additional things to keep in mind:

- The Access Bank loan code is only available to Access Bank customers in Nigeria.

- There is a limit to the amount of money you can borrow using the loan code.

- You will need to have a good credit history to be eligible for a loan.

- Interest rates and repayment terms vary depending on the loan product you choose.

If you have any questions about the Access Bank loan code or the loan products offered by the bank, you can contact Access Bank customer support for assistance.

Access Bank Loan Code Requirements

The following are the general requirements for applying for a loan using the Access Bank loan code:

- You must be an Access Bank customer.

- You must have a good credit history.

- You must have a valid BVN (Bank Verification Number).

- You must be able to provide proof of income (for salary earners).

Additional requirements may apply depending on the type of loan you are applying for.

For example, to apply for a Payday Loan, you must have a phone number that is linked to your BVN and evidence that you received salary payment in the previous month.

To learn more about the specific requirements for each type of loan, you can visit the Access Bank website or contact customer support.

Here are some tips for improving your chances of getting approved for an Access Bank loan:

- Make sure you have a good credit history. You can check your credit report for free on the Credit Bureau of Nigeria website.

- Pay your bills on time and in full each month.

- Avoid taking out too many loans at the same time.

- Keep your account balance positive.

- Have a steady income.

If you are not approved through the access bank loan code, you can try applying again after a few months.

You may also want to consider increasing your income or reducing your debt before applying again.

Wrapping Up On Access Bank Loan Code

Access Bank offers a variety of loan products to its customers, including loans that can be applied for using the Access Bank loan code.

This is a convenient way for customers to get quick access to cash, without having to visit a branch.

However, it is important to note that the Access Bank loan code is only available to Access Bank customers, and there are limits to the amount of money you can borrow and the types of loans you can apply for using the loan code. You will also need to have a good credit history to be eligible for a loan.

If you are considering applying for an Access Bank loan, it is important to compare the different loan products available and choose the one that is right for your needs.

You should also carefully read the terms and conditions of the loan even if you are applying through access bank loan code, so that you understand the interest rates, repayment terms, and other fees associated with the loan.